Transforming technology: Index Ventures announces £1.79 billion in new funding

“This is your world. Shape it or someone else will.”

In a modern, technological world, where every day brings with it a new technology that shapes the world, we need investors more than ever to support these technology companies that make a difference.

Because companies have the potential to change the course of human history for the better, it is important that they have a guide, a wise guide pointing the finger in the right direction. That leader, that helper, companies can find at Index Ventures.

Leading the Transformation

Ventures IndexIndex, a leading global venture capital firm, has announced £1.79 billion in new funding to forge relationships with exceptional entrepreneurs who are building transformative, category-defining businesses. Combined with Index’s existing £231.5 million Origin seed fund, Index is deploying £2 billion of capital to support founders from seed to IPO. This brings the total capital raised by Index since its founding to £11.6 billion.

The company’s fundraising comes at a pivotal moment for the global startup ecosystem. The rise of transformative technologies like AI, the emergence of tried-and-true playbooks for hypergrowth companies, and the critical mass of experienced global talent are all feeding off and accelerating each other. The result is that entrepreneurs are at a historic inflection point where they have unprecedented opportunities to create new, category-defining businesses.

Rise and growth

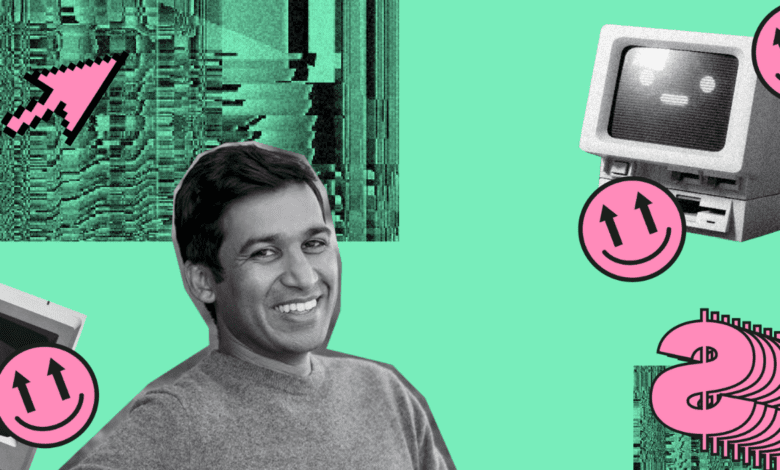

“While technology has transformed our everyday lives, the reality is that there is still a lot to be done,” says Shardul Shah, partner at Index Ventures.

With its new £617 million venture fund and £1.16 billion growth fund, Index is positioned to be the best long-term partner for entrepreneurs building this new foundation, wherever they are in the world.

“We are energized by the unique opportunities this historic moment presents and excited to partner with founders to solve the world’s most complicated and consequential problems,” adds Shardul.

A record of records, an international influence

With a significant presence spanning from San Francisco in the West to Tel Aviv in the East — spanning ten time zones and 24 of the world’s 30 most vibrant ecosystems — Index positions itself as a major player in our modern world. Established on the West Coast with a portfolio that includes Figma, Discord, Notion, and Roblox, Index has expanded its U.S. presence with a new office in New York. Index continued to strengthen its U.S. leadership by welcoming former Airbnb executive Vlad Loktev to the San Francisco office, who has been instrumental in driving Airbnb’s growth and product strategy during his more than decade at the company.

Index has a nearly three-decade track record of identifying, nurturing and partnering with visionary founders. The majority of these partnerships begin early in a company’s life, at Seed and Series A. Index has invested in 109 companies that have reached a £780 million valuation, 22 that have exceeded a £7.8 billion valuation and 57 that have gone public. The businesses in Index’s portfolio have created 200,000 jobs to date and are on track to hire an additional 20,000 in the next 12 months.

A portfolio that can only be highlighted

Magicthe cloud security company in which Index was an early investor, grew to 100x its value in 18 months – becoming the fastest company to reach £78m in ARR in that time. Wiz has now reached over £270m in ARR and serves over 40% of the Fortune 100;

AI Scale recently raised £780 million and doubled its valuation to £10.8 billion, and its data foundry powers nearly every major large language model;

DeepLthe language AI company, is transforming the language industry, which is projected to grow to £73.5bn by 2028. The index led DeepL’s £231.5m raise at a £1.54bn valuation earlier this year;

Revolutionthe all-in-one financial platform, announced revenues of over £1.69 billion in 2023, with record pre-tax profits of £420.5 million and 45 million customers worldwide.