Shenzhen Envicool Technology (SZSE:002837) Return Trends Look Promising

Finding a business with substantial growth potential is not easy, but it is possible if we look at some important financial metrics. In a perfect world, we would like to see a company investing more capital into its business and, ideally, the returns made on that capital would also increase. If you see this, it typically means it’s a company with a great business model and lots of profitable reinvestment opportunities. With that in mind, we noticed some promising trends in Shenzhen Envicool Technology (SZSE:002837) so let’s look a little deeper.

What is return on capital employed (ROCE)?

For those who don’t know, ROCE is a measure of a company’s annual pretax profit (its return), relative to the capital employed in the business. The formula for this calculation at Shenzhen Envicool Technology is:

Return on capital employed = earnings before interest and taxes (EBIT) ÷ (total assets – current liabilities)

0.18 = CN¥492 million ÷ (CN¥5.1b – CN¥2.4b) (Based on the last twelve months to March 2024).

Therefore, Shenzhen Envicool Technology has an ROCE of 18%. By itself, that’s a standard return, but it’s much better than the 5.6% generated by the Machinery industry.

See our latest analysis for Shenzhen Envicool Technology

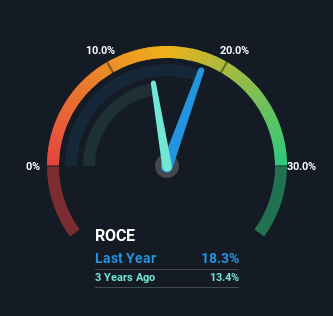

In the chart above we measure Shenzhen Envicool Technology’s past ROCE against its past performance, but the future is arguably more important. If you wish, you can check out the forecasts from analysts covering Shenzhen Envicool Technology for free.

What does the ROCE trend for Shenzhen Envicool technology tell us?

Investors would be pleased with what is happening at Shenzhen Envicool Technology. Data shows that return on capital has increased substantially over the past five years, to 18%. The company is effectively making more money per dollar of capital used, and it is important to note that the amount of capital has also increased, by 141%. This may indicate that there are many opportunities to invest capital internally and at increasingly higher rates, a common combination among multi-baggers.

On a separate but related note, it’s important to know that Shenzhen Envicool Technology has a current liabilities to total assets ratio of 47%, which we would consider quite high. This can bring some risks because the company basically operates with a large dependence on its suppliers or other types of short-term creditors. Ideally, we would like to see this reduction, as it would mean fewer risky obligations.

The bottom line of Shenzhen Envicool Technology’s ROCE

In short, Shenzhen Envicool Technology has proven that it can reinvest in the business and generate higher returns on capital employed, which is fantastic. And with stocks performing exceptionally well over the past five years, these patterns are being taken into account by investors. That said, we still think the promising fundamentals mean the company deserves more due diligence.

On a separate note, we discovered 1 Warning Sign for Shenzhen Envicool Technology you’ll probably want to know.

While Shenzhen Envicool Technology may not currently earn the highest returns, we have compiled a list of companies that currently earn over 25% return on equity. Look this free list here.

Assessment is complex, but we are helping to make it simple.

Find out if Shenzhen Envicool Technology is potentially over or undervalued by checking our comprehensive analysis, which includesfair value estimates, risks and caveats, dividends, insider transactions and financial health.

See the free analysis

Do you have feedback on this article? Worried about the content? Get in touch with us directly. Alternatively, email the editorial team (at) Simplywallst.com.

This Simply Wall St article is general in nature. We provide commentary based on historical data and analyst forecasts using only an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take into account your objectives or your financial situation. Our goal is to bring you long-term focused analysis driven by fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St has no position in any of the stocks mentioned.

Assessment is complex, but we are helping to make it simple.

Find out if Shenzhen Envicool Technology is potentially over or undervalued by checking our comprehensive analysis, which includesfair value estimates, risks and caveats, dividends, insider transactions and financial health.

See the free analysis

Do you have feedback on this article? Worried about the content? Please contact us directly. Alternatively, email editorial-team@simplywallst.com