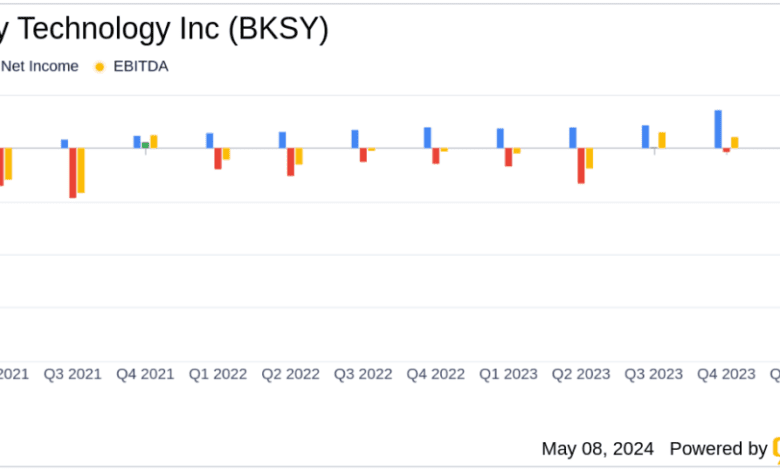

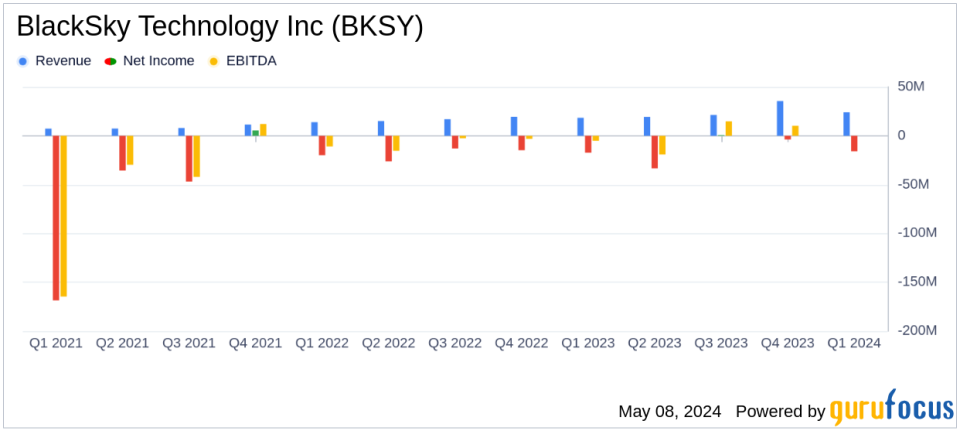

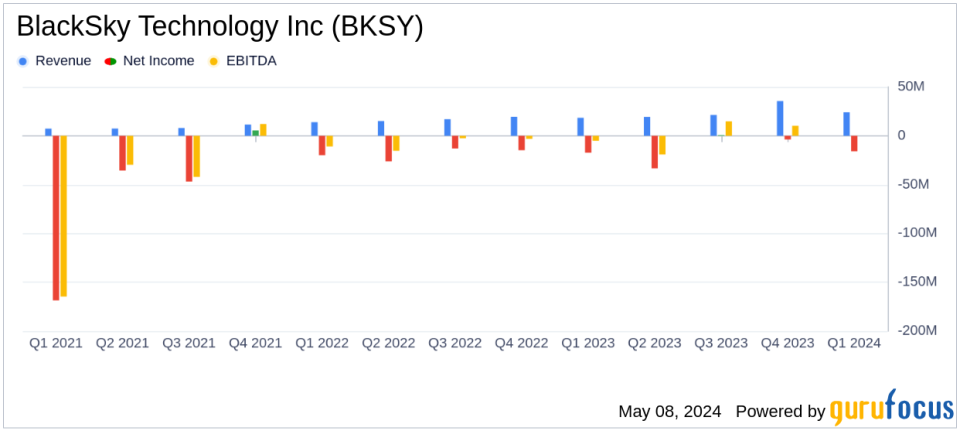

Revenue increases, net loss reduction

-

Revenue: Reported at $24.2 million, a 32% increase from the previous year, but falling short of estimates of $25.06 million.

-

Net loss: Recorded at US$15.8 million, an improvement over the previous year’s net loss of US$17.3 million, but above the estimated net loss of US$11.85 million.

-

Earnings per share (EPS): The loss per share was US$0.11, greater than the estimated loss per share of US$0.08.

-

Gross Margin Improvement: Cost of sales as a percentage of revenue for image analytics and software services improved to 19% from 23% year over year.

-

Operational expenses: It totaled US$30.5 million, including non-cash expenses, up slightly from US$28.8 million the previous year.

-

Adjusted EBITDA: It turned positive at $1.4 million, a significant improvement from a loss of $4.1 million the previous year.

-

Capital Expenditures: It totaled US$14.6 million, with continued investments in Gen-3 satellites.

On May 8, 2024, BlackSky Technology Inc. (NYSE: BKSY) released its 8-K filing, detailing its financial results for the first quarter ending March 31, 2024. The company reported a significant 32% increase in revenue , totaling US$ 24.2. million, compared to the same period last year. This growth is attributed to robust demand for its real-time geospatial intelligence services, which include high-frequency imagery and analytics.

BlackSky, a leading provider of real-time geospatial intelligence, operates an advanced constellation of low Earth orbit (LEO) satellites optimized for cost-effective, on-demand imaging. The company’s Spectra AI software platform processes data from its constellation and other sensors, providing critical insights and analysis to customers in North America, the Middle East, Asia and other regions.

Financial Highlights and Operational Achievements

The company’s revenue growth was driven by a 13% increase in software and image analytics services, which totaled $17.8 million, and a significant 143% increase in engineering and professional services revenue, reaching $ 6.4 million. This increase in professional services revenue reflects the acquisition of new clients and the advancement of large international contracts. Additionally, BlackSky achieved a reduction in cost of sales as a percentage of revenue, improving from 35% in Q1 2023 to 29% in Q1 2024, demonstrating greater operational efficiency.

BlackSky’s net loss for the quarter narrowed to $15.8 million from $17.3 million a year earlier. The company also reported adjusted EBITDA of $1.4 million, a substantial improvement from a loss of $4.1 million in the first quarter of 2023. This positive change is primarily due to higher revenues, improved gross margins and reduction of cash operating expenses.

Strategic Developments and Future Perspectives

During the quarter, BlackSky secured $30 million in new contracts and renewal agreements, including a notable $24 million contract with the Air Force Research Laboratory. These contracts underscore the company’s critical role in providing actionable intelligence for strategic decision-making. BlackSky is also making progress with its Gen-3 satellites, planning launches throughout the year to enhance its imaging and analytical capabilities.

Looking ahead, BlackSky maintains its 2024 revenue outlook, projecting between $102 million and $118 million, and anticipates Adjusted EBITDA between $8 million and $16 million. The company’s capital expenditures are expected to range between $55 million and $65 million, primarily for the development of Gen-3 satellites.

Investor and Analyst Perspectives

BlackSky’s performance this quarter reflects a solid trajectory toward sustainable growth and profitability, driven by strategic contract wins and operational efficiencies. The company’s continued investments in satellite technology and intelligence capabilities position it well to capitalize on the growing global demand for real-time, space-based intelligence solutions.

Investors and analysts can see these results as proof of BlackSky’s robust business model and its ability to adapt and thrive in the dynamic geospatial intelligence market. The increased financial flexibility of its new $20 million commercial banking line also provides BlackSky with the resources to pursue new growth initiatives and strengthen its market position.

For further details, BlackSky will host a conference call and webcast for the investment community, providing an opportunity to discuss these results and future plans in more depth.

Explore BlackSky Technology Inc’s full 8-K earnings release (here) for more details.

This article first appeared on GuruFocus.