Madison Square Garden Entertainment Corp. Reports Fiscal Third Quarter Earnings: A Detailed Look

-

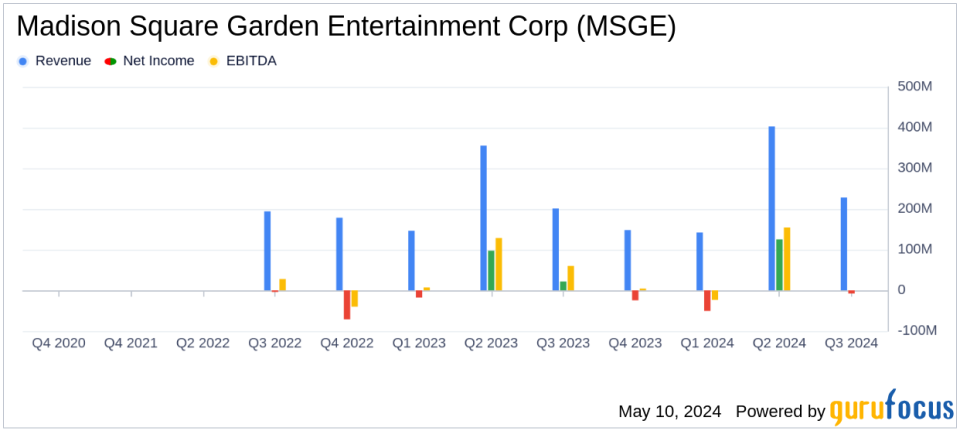

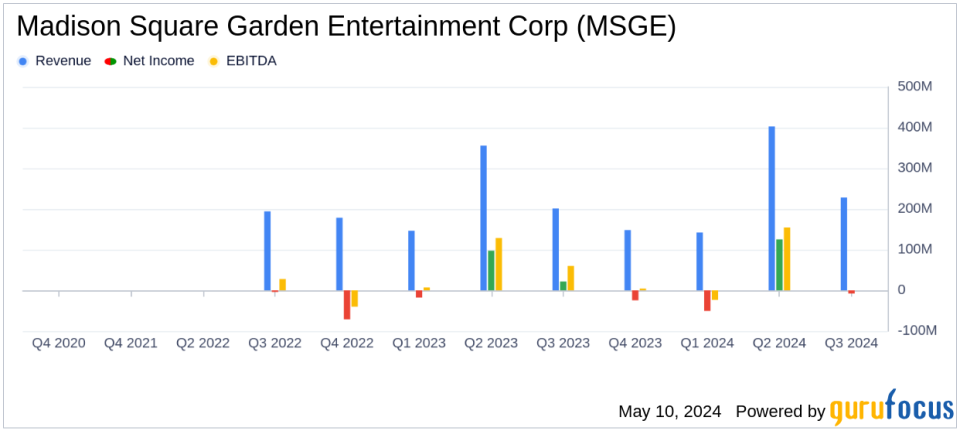

Revenue: It reported $228.3 million for the fiscal third quarter, marking a 13% year-over-year increase, exceeding the $226.55 million estimate.

-

Net income: It reached US$2.8 million, significantly below the US$8.56 million estimated for the quarter.

-

Earnings per share (EPS): Registered at US$0.06, falling short of the estimated US$0.17.

-

Operating income: Decreased 32% year-over-year to $16.8 million, reflecting increased operating costs and higher selling, general and administrative expenses.

-

Adjusted Operating Profit: Decreased 23% to $38.5 million from the previous year, impacted by higher expenses despite revenue growth.

-

Financial Guidance: Lowered FY24 revenue forecast to $940-950 million and increased operating income outlook to $100-110 million, indicating positive business momentum.

-

Operational highlights: It saw a low double-digit percentage increase in event bookings, driven by robust growth in the number of shows at corporate venues.

On May 9, 2024, Madison Square Garden Entertainment Corp. (NYSE:MSGE) released its 8-K filing, detailing financial results for the fiscal third quarter ending March 31, 2024. The report reveals a combination of growth in revenue along with challenges in operating and adjusted operating profit.

Madison Square Garden Entertainment Corp. is known for its dynamic portfolio of iconic venues and entertainment offerings. With properties such as Madison Square Garden and Radio City Music Hall in New York, MSGE specializes in live events ranging from sports to concerts that attract millions annually. This quarter, the company reported an increase in revenue to $228.3 million, a 13% increase year-over-year, driven primarily by an increase in the number of concerts and events.

Financial Performance Overview

Despite the increase in revenue, MSGE faced declines in both operating profit and adjusted operating profit, which decreased by 32% and 23%, respectively. The company cited increased selling, general and administrative expenses as the main reasons for these declines. Specifically, operating profit was $16.8 million, a decrease from $24.7 million the previous year. Adjusted operating profit was reported at $38.5 million, down from $50.2 million in the year-ago quarter.

Revenue streams and operating costs

MSGE’s revenue increase was attributed to robust performance in its reservations business, with significant contributions from entertainment offerings that generated $146.2 million, marking a 13% increase. This segment benefited from higher event-related revenues and suite license fee revenues, reflecting the company’s strong operational execution and strategic positioning.

However, the cost associated with these recipes has also increased. Direct operating expenses related to entertainment offerings, arena license fees and other leases increased 25% to $113.0 million. This increase was essentially due to the greater number of concerts and the associated expenses per event.

Strategic adjustments and future perspectives

In response to current performance trends, MSGE has adjusted its fiscal 2024 guidance. The company now forecasts revenues between $940 million and $950 million, narrowing the previous forecast range. Additionally, both operating income and adjusted operating income projections for the year have been increased to ranges of $100-110 million and $200-210 million, respectively.

James L. Dolan, Executive Chairman and CEO, expressed confidence in the company’s trajectory, stating, “Our business continues to exceed our original expectations for fiscal 2024 and we are on track to generate robust growth in our first full year as an independent public company.”

Implications for investors and the market

While the increase in revenue is a positive indicator of MSGE’s ability to attract large audiences and host successful events, the decline in profitability metrics such as operating profit raises concerns. Investors may be cautious, focusing on how the company plans to manage its expenses and whether it can sustain revenue growth while improving profitability.

Overall, Madison Square Garden Entertainment Corp.’s third-quarter fiscal report was 2020. paints a picture of a company that has successfully grown its revenue through increased event activity, but faces challenges in translating that growth into improvements in net profit. The adjustments to the financial guidelines reflect management’s proactive stance in overcoming these challenges, while also aiming to increase shareholder value in the coming periods.

Explore Madison Square Garden Entertainment Corp’s full 8-K earnings release (here) for more details.

This article first appeared on GuruFocus.