Exceeds analyst expectations with strong performance

-

Adjusted Operating Profit: It reached a record $90.0 million in the third quarter, increasing 29% sequentially and 129% year over year, exceeding quarterly guidance.

-

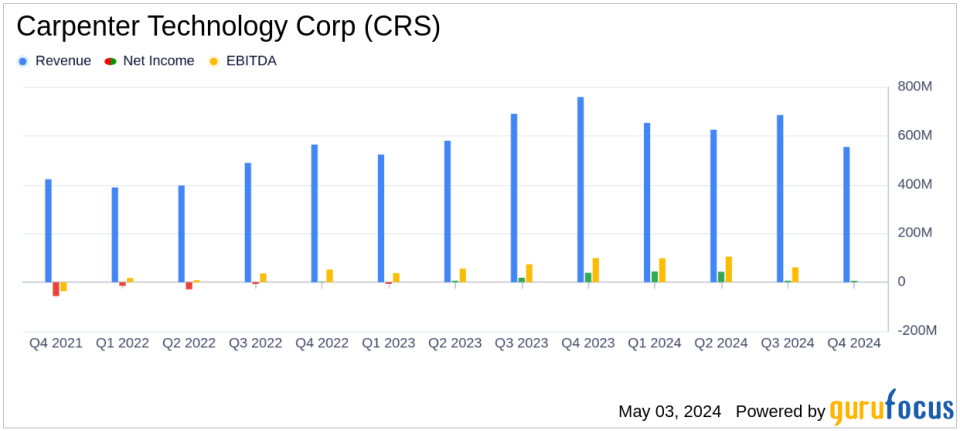

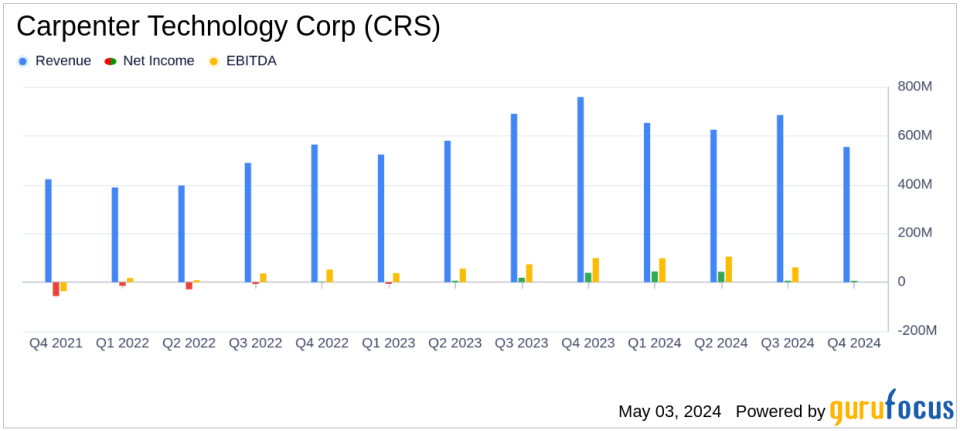

Revenue: Reported $684.9 million in net sales, with $553.8 million excluding surcharges, marking a sequential increase of $68.5 million and a year-over-year increase of $62.3 million.

-

Net income: Posted US$6.3 million, significantly below the US$65.10 million estimate, impacted by special items including a goodwill impairment charge.

-

Earnings per share (EPS): Recorded diluted EPS of $0.12, adjusted for special items to $1.19, which fell short of estimated EPS of $1.30.

-

Free cash flow: It generated $61.9 million in adjusted free cash flow, showing a strong recovery from negative free cash flow in the previous quarter.

-

Segment performance: The SAO segment outperformed with $103.5 million in operating revenue, achieving an adjusted operating margin of 21.4%.

-

Future outlook: Increased Q4 FY24 outlook by approximately 8%, indicating continued operational improvement and margin expansion.

On May 1, 2024, Carpenter Technology Corp (NYSE:CRS) released its third quarter earnings for fiscal year 2024, delivering exceptional financial results that surpassed analyst projections. The company reported these findings in its recent 8-K filing. Carpenter Technology, a leader in the development, manufacturing and distribution of specialty alloys, operates primarily through its Specialty Alloys Operations (SAO) and Performance Engineered Products (PEP) segments, with the former contributing the majority of its revenue.

Financial highlights and analyst comparisons

Carpenter Technology reported a substantial increase in adjusted operating profit, reaching $90 million, marking 29% sequential growth and a 129% year-over-year increase. This performance significantly surpassed third quarter guidance by approximately 18% and led to an optimistic increase in the fourth quarter outlook by approximately 8%. The company’s net sales, excluding surcharge income, were $553.8 million, showing a robust increase from the previous quarter and exceeding the estimated revenue of $781.4 million for the quarter.

Adjusted diluted earnings per share for the third quarter was $1.19, which also beat the analyst estimate of $1.30 per share. The company’s strategic operations in the aerospace and defense sectors, as well as the medical sectors, have been particularly fruitful, with these markets notably contributing to increased revenues.

Operational excellence driving growth

The SAO segment, which constitutes the core of Carpenter’s operations, reported operating profit of $103.5 million with an adjusted operating margin of 21.4%. This represents a significant improvement both sequentially and year over year, driven by higher volumes and an improved mix, particularly in the aerospace and defense and medical end-use markets.

The PEP segment also showed positive dynamics, although more modest, with an operating profit of US$9.2 million in the quarter, reflecting strategic adjustments and greater productivity in manufacturing facilities.

Challenges and strategic perspectives

Despite the impressive financial performance, Carpenter Technology noted several potential challenges, including the cyclical nature of the specialty materials business and various market uncertainties such as geopolitical tensions and economic fluctuations. However, the company remains committed to its strategic initiatives, with the objective of doubling its operating profit by 2026, advancing its original objective for 2027.

The company’s focus on high-value applications in growth sectors such as aerospace, defense and medical devices, coupled with continuous improvements in productivity and cost-effectiveness, positions it well to weather potential headwinds and capitalize on market opportunities.

Conclusion

With a record backlog driven by strong underlying demand and consistent performance across all of its operating segments, Carpenter Technology Corp (NYSE:CRS) is poised for sustained growth. The strategic direction led by President and CEO Tony Thene, together with the company’s solid financial health, underscores its ability to maintain a competitive advantage in the special alloys market.

Investors and stakeholders can look forward to continued progress and strategic developments from Carpenter in the coming quarters.

Explore Carpenter Technology Corp’s full 8-K earnings release (here) for more details.

This article first appeared on GuruFocus.