A detailed comparison with…

-

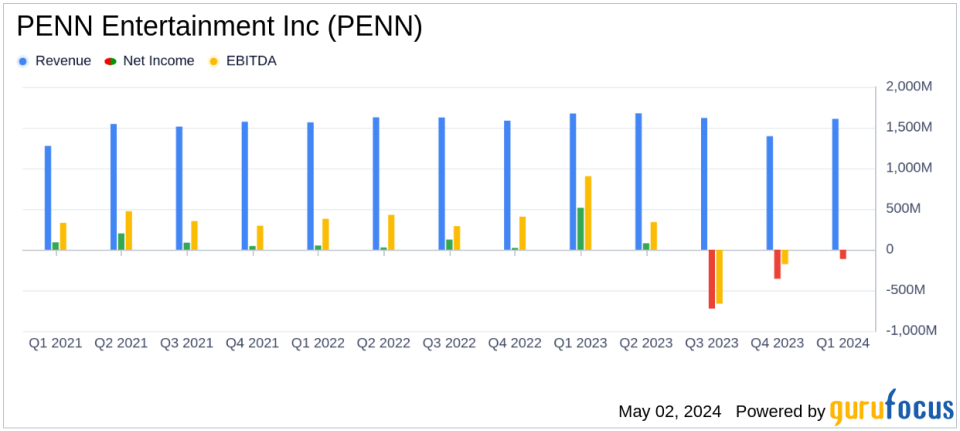

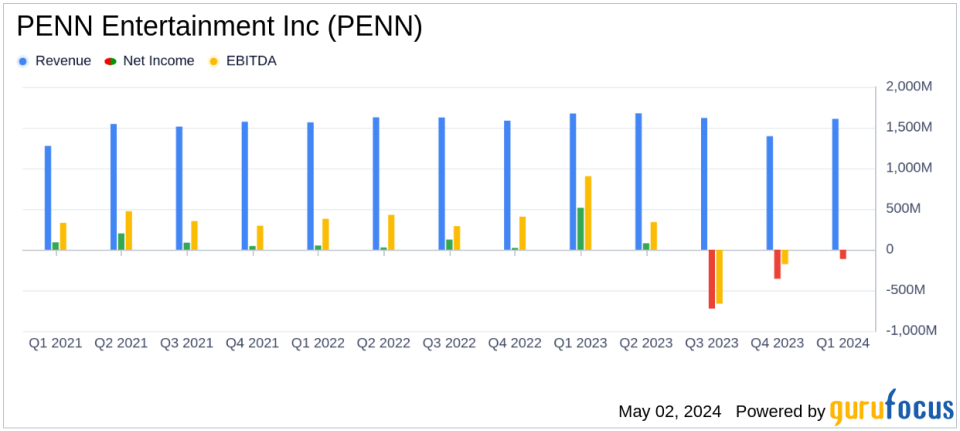

Revenue: It reported US$1,606.9 million, a decrease from the previous year’s US$1,673.3 million, falling short of estimates of US$1,626.37 million.

-

Net income: It reported a net loss of US$114.9 million, compared with a net profit of US$514.4 million the previous year, significantly worse than the estimated net loss of US$89.95 million.

-

Earnings per share (EPS): It reported a loss of $0.76 per share, worse than the estimated loss of $0.59 per share.

-

Adjusted EBITDAR: It totaled $256.2 million, down from $478.2 million year-over-year, indicating a decrease in profitability.

-

Liquidity: Total liquidity was $1.9 billion as of March 31, 2024, supported by $903.6 million in cash and cash equivalents.

-

Debt position: Traditional net debt was $1.73 billion, with a lease-adjusted net leverage ratio of 7.2x.

-

Interactive segment: Faced challenges with a reported adjusted EBITDA loss of $196.0 million, attributed to lower-than-expected user retention and spending on online sports betting and iCasino platforms.

PENN Entertainment Inc (NASDAQ:PENN) released its 8-K filing on May 2, 2024, disclosing its financial performance for the first quarter ended March 31, 2024. The company reported a net loss of $114.9 million , a significant deviation from the previous one. net profit for the year of US$514.4 million. This performance contrasts sharply with analysts’ estimates that projected a smaller net loss of US$89.95 million. Earnings per share (EPS) came in at -$0.76, also missing the estimated EPS of -$0.59. Despite these challenges, the company generated revenue of $1.606 billion, slightly below analyst expectations of $1.626 billion.

About PENN Entertainment Inc.

PENN Entertainment, originally founded in 1972 with a race track in Pennsylvania, has become a major player in the entertainment and gaming industry. Operating 43 properties in 20 states, PENN manages well-known brands such as Hollywood Casino and Ameristar. The company’s portfolio is heavily focused on land-based casinos, which represented 89% of its total sales in 2023, with the remainder coming from interactive segments, including sports betting and iGaming.

Quarterly performance insights

The quarter recorded mixed results across different segments. The real estate segment reported revenues of $1.4 billion with an adjusted EBITDAR of $479 million, translating to a margin of 34.1%. This resilience was overshadowed by setbacks in the Interactive segment, which faced a loss due to unfavorable retentions from major sporting events, despite achieving record numbers of online sports betting and iCasino gross gaming revenues.

Strategic Developments and Management Commentary

CEO Jay Snowden highlighted the resilience of property-level performance and the challenges facing the Interactive segment. He remains optimistic about the future, especially with upcoming media enhancements and integrations with ESPN that are expected to increase product offerings ahead of the 2024 football season. Aaron LaBerge’s recent appointment as Chief Technology Officer aims to further advance PENN’s technological strategy, especially in the Interactive division.

Financial Position and Future Prospects

As of March 31, 2024, PENN reported a robust liquidity position of $1.9 billion, including $903.6 million in cash and cash equivalents. The company’s net debt was US$1.7 billion. Despite current losses, these numbers reflect a stable financial base, capable of supporting ongoing and future operations.

Addressing environmental, social and governance (ESG) initiatives

PENN is also advancing its ESG commitments. The publication of the 2023 Corporate Social Responsibility Report on April 23 highlights significant advances in environmental, social and governance initiatives. Activities such as celebrating Black History Month and participating in Earth Day emphasize the company’s commitment to social and environmental responsibilities.

Conclusion

Although PENN’s Q1 2024 earnings deviated from analyst expectations, the company’s strategic initiatives, especially in enhancing its digital offerings and ESG commitments, lay a foundation for potential future growth. Investors and stakeholders will closely monitor the development of these strategies in the coming quarters, especially with the improvements expected in the Interactive segment.

Communications with Investors and Analysts

PENN has scheduled a conference call and webcast to discuss quarterly results and recent developments, providing an opportunity for investors and analysts to gain deeper insights into the company’s strategies and outlook.

For detailed financial numbers and future updates, interested parties are encouraged to consult the official 8-K filing and monitor upcoming investor communications.

Explore PENN Entertainment Inc’s full 8-K earnings release (here) for more details.

This article first appeared on GuruFocus.