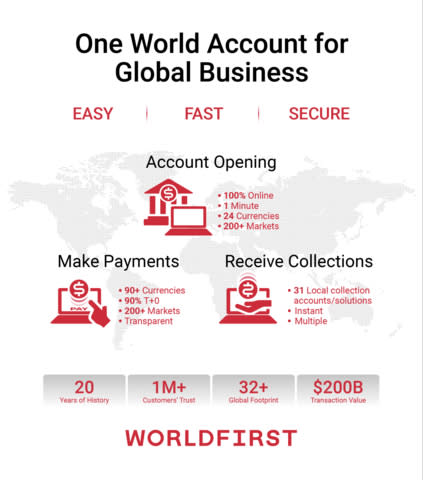

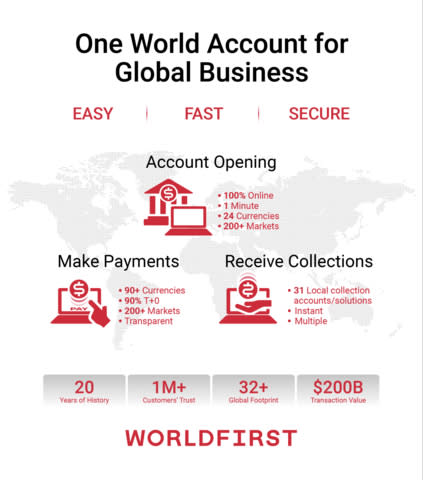

WorldFirst World Account enables instant cross-border business payment functionality in over 200 markets

-

Feature to enable instant international payments between World Account users globally

-

WorldFirst further increases transaction speed, with the World Account now settling 90% of payments within one business day

-

World Account supports same-day payment settlement from the UK and Europe to the APAC region, compared to the typical 2-5 days for most banks

-

World Account supports global billing in over 30 currencies and global payments in nearly 100 currencies

LONDON, 30 July 2024–(BUSINESS WIRE)–WorldFirst, a unique digital payment and financial services platform for global businesses, especially serving SMEs in international trade, has launched a function to enable real-time payments between holders of its flagship multi-currency business account, the World Account, as WorldFirst continues to increase the speed and efficiency of secure international business payments.

This feature will benefit UK and European SMEs importing from international markets. This capability enables these businesses to promptly pay their overseas suppliers without incurring any costs, ensuring timely receipt of goods and cost savings to support their business growth. With World Account, SME importing businesses can pay suppliers in over 200 markets worldwide using over 90 currencies.

In particular, SMEs in the UK and EU that source from China can now pay a wide range of suppliers who are also World Account users in seconds, thanks to WorldFirst’s extensive customer base in the country. In 2023, China was the largest import destination for the UK and EU.

WorldFirst has also expanded its one-business-day settlement capability to cover 90% of all World Account transactions, providing SMEs around the world with fast payments to increase revenue and save costs. In the UK and Europe, WorldFirst supports same-day settlement for payments to markets in the APAC region, including mainland China, Singapore, Hong Kong SAR of China, Australia, Vietnam, Malaysia, Thailand, Japan and New Zealand, compared to the typical 2-5 days that banks in the region typically require.

Payment speed is a major pain point for SMEs when it comes to global transactions. The Financial Stability Board (FSB), an international body that monitors and advises on the global financial system, lists speed, along with cost, transparency and access, as four challenges in cross-border payments. A recent analysis shows that it takes between five and ten days for payments to reach the destination account. As a result, many SMEs struggle to access international markets.

“We are providing fast and secure payments with customer funds deposited in leading banks around the world, which are our long-standing partners,” said Sumit Arora, Managing Director UK & Europe at WorldFirst. “WorldFirst also leverages AI and other technologies to conduct comprehensive fraud prevention and risk assessment, ensuring a streamlined and secure payment process for our customers.”

WorldFirst’s tailored industry solutions for e-commerce sellers looking to expand overseas. In one minute and entirely online, e-commerce sellers can open a World Account to access 30+ local currency accounts and solutions while managing all their accounts across multiple online stores. This integrated platform also allows them to pay their suppliers and handle VAT payments effortlessly. WorldFirst helps SMEs quickly establish and scale their presence on 130+ global e-commerce marketplace platforms, including Amazon, SHEIN, Wayfair, etc.

WorldFirst is a leading payment services provider in the UK; offering local currency accounts. By offering more local currency accounts, WorldFirst expands the opportunities for its e-commerce customers to sell in more countries, as most local e-marketplaces will only pay sales profits to accounts based in the country in which the e-marketplace operates. For businesses that receive money directly from their customers, they can receive funds faster and more cost-effectively by having their customers settle into a local currency account.

About WorldFirst

WorldFirst is a unique digital payment and financial services platform for global businesses, especially SMEs in international trade. WorldFirst empowers SMEs to successfully execute their strategic growth plans with technology. WorldFirst’s World Account serves SMEs engaged in international business, supporting online businesses selling on marketplaces and websites, as well as importers and exporters. Services include receiving payments, making payments, currency conversion, risk management and supply chain financing to help clients reduce costs, improve invoicing efficiency to generate more revenue and sales, and quickly capture global business opportunities. Founded in London in 2004, WorldFirst merged with Ant Group in 2019.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240730289426/en/

Contacts

media

Media@worldfirst.com